What is Retail Media?

Retail Media is a method of advertising to users of a retailer’s website or app. Its significance has risen since the pandemic, as users increasingly transact with retailers online. The important factors behind its growth from the advertisers’ standpoint are access to high intent traffic and enhanced performance tracking in a post-cookie/ATT (Apple Tracking Transparency) world that has amplified measurement challenges. On the other hand, with onsite advertising gross margins between 70-90%, retailers can improve profitability through this new found revenue stream, in an industry plagued by low margins.

BCG estimates that retail media will command 25% of the global digital ad spend and grow to around 100 Billion USD by 2026.

Players and Amazon’s Ad business growth:

It may come as no surprise, Amazon with a 50% share of the US e-commerce market, is the partner of choice for advertisers, and in this year will command the lions’ share of retail media ad budgets at 77% (source:emarketer.com). Walmart comes in second at 6.2%, instacart and eBay are also competing with 1.9% and 1.1% share respectively in 2022

Amazon Ad Types:

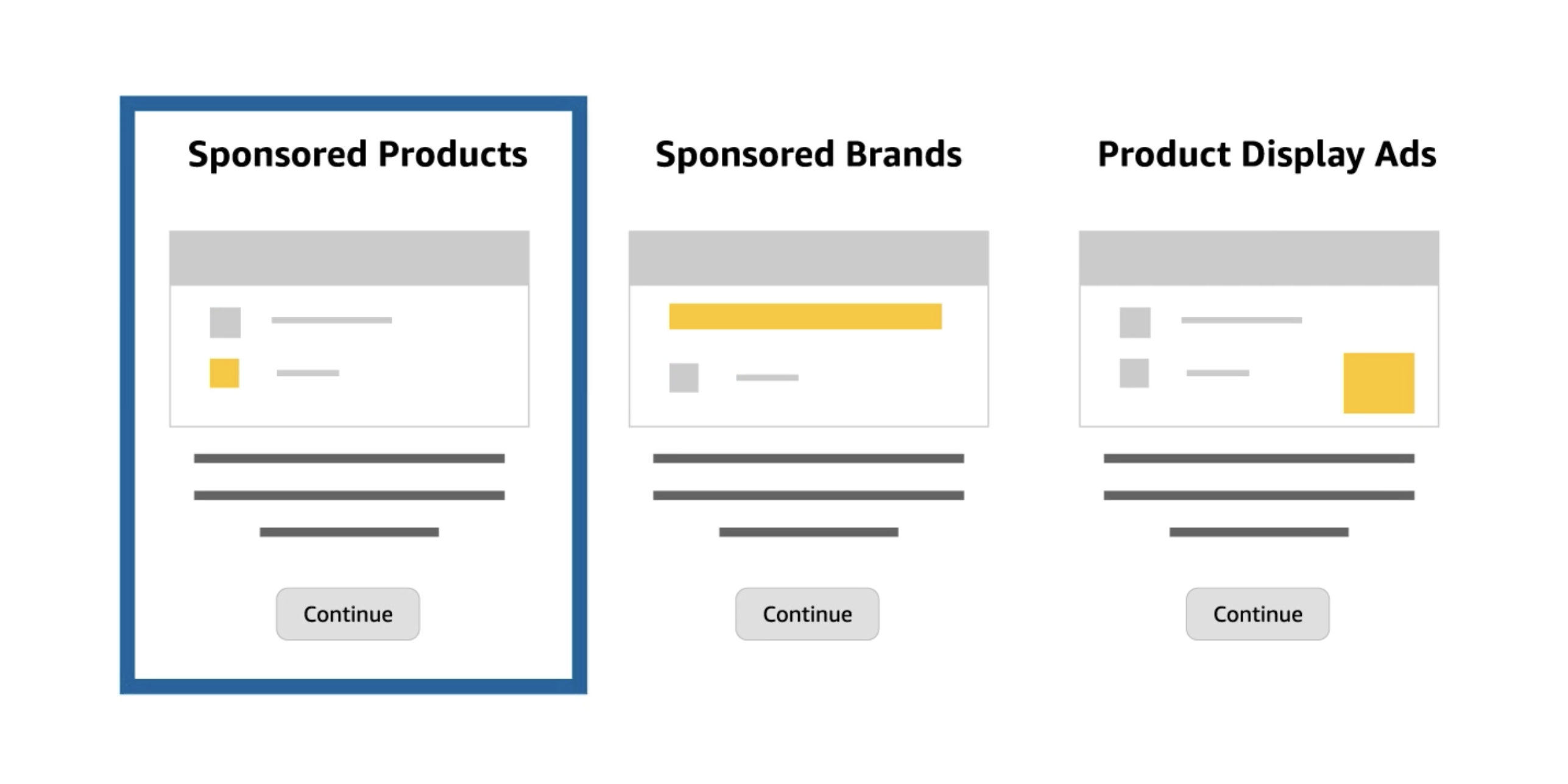

Amazon offers 3 types of onsite-ads:

- Sponsored Products: These are sponsored listings appearing among organic content in the search results

- Sponsored Brands: This format allows advertisers to show ads on the top row of the search results page, and is ideal for generating awareness

- Product Display ads, are display ad banners appearing on the right side of the page

Most of the budgets are allocated to sponsored products followed by sponsored brands. Amazon also offers Amazon DSP, their programmatic ad solution, for advertising on and off Amazon. The Demand side platform (DSP) allows advertisers to reach amazon users around the web on amazon owned properties like amazon.com, imdb, and various other publishers by participating in auctions conducted on ad exchanges. Video ads, Connected TV inventory and audio can also be purchased by advertisers through the DSP solution.

As per insider intelligence Amazon Ads have captured 13.3% of the US digital ad market, and seems to be catching up with Google (27.7% market share), and Facebook (24.2%) quite rapidly.

To understand how amazon has grown its advertising business we need to compare amazon ppc -the largest contributor to its ad business, with other search advertising options. We will focus on the one’s offered by Google for now.

Comparison of Amazon PPC and Google Search products:

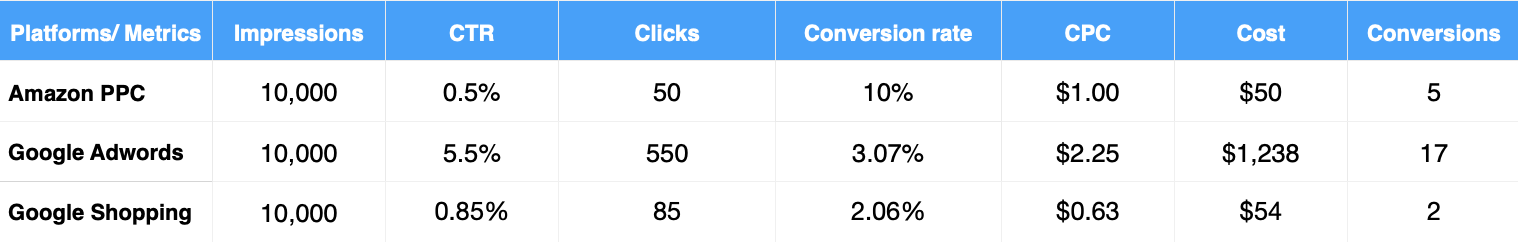

Below is a comparison of the platforms compiled from sources such as wordstream, and Skai. We are working with averages here, so the data for an advertisers’ particular category may vary. This should though provide some insight into the performance of these ads.

If an ad is shown 10,000 times, on these platforms, below are the results we can expect:

Now it’s pretty evident from the above that, google’ Adwords and shopping ads have a higher CTR and are able to drive more volume of conversions. If we are measuring the likelihood and volume of responses from users when they are shown ads, google’s search products outperform Amazon.

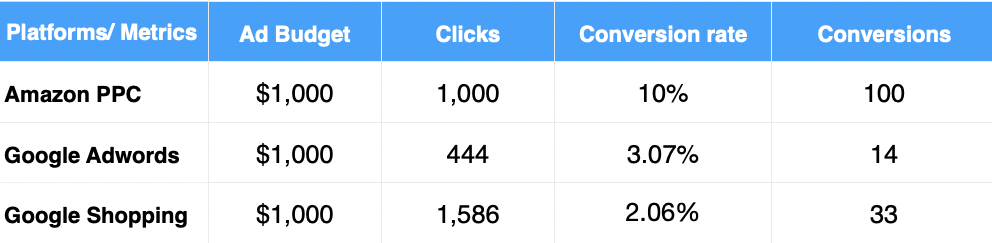

But, practically speaking, advertisers are limited by budgets and they want to maximize the number of conversions per dollar spend. If we look at what results a $1000 allocation to each platform would bring, Amazon is the clear winner. You get more clicks per 1000 dollars spent on Amazon, which is a thousand clicks in this example. And more importantly, on conversions, it outperforms Google adwords and Google shopping by 7x and 3x respectively.

Now of course, there are limitations to this analysis, namely:

- Cannibalization of organic sales is assumed to be the same across platforms

- We are working with averages across all categories

- The above rates are based on last click attribution. As most advertising today prioritizes the Last click attribution model, we are ignoring the roles of multiple-channels in assisting the conversion.

But the magnitudes of efficiency in terms of conversions, cost and clicks by which Amazon is leading is quite large, and advertisers are quite rightly voting for Amazon with their budgets.

Key Factors

A high quality audience, better measurability, and efficient pricing, are the key reasons Amazon PPC is outperforming google search. Even if the average CTR of Amazon ads is lower, the cheaper CPCs allow advertisers to get more conversions out of their ad budgets.

Meta also understands the importance of controlling the shopping experience. In certain markets, it is integrating new shopping features with its platforms like Facebook and instagram, allowing users to transact on its sites.

It will be interesting to see how major advertising platforms evolve, and what strategies they would adopt to counter Amazon’s unabated growth in the digital ad industry.

Related Posts

August 25, 2022

Getting the most out of your A/B testing

Last year I wrote about why booking too far in advance can be dangerous for…